BURLINGTON, Mass., February 8, 2018 – Nuance Communications, Inc. (NASDAQ: NUAN) today announced financial results for its first quarter fiscal 2018, ended December 31, 2017.

“Three years ago, we undertook a plan to transform our business and today, with our first quarter results, we reached a milestone of returning to organic growth,” said Dan Tempesta, Nuance’s chief financial officer. “This progress is the result of multiple initiatives designed to drive efficiencies in the business and to reinvest in innovation, sales, channels

The Company continues to capture new customers and to expand its business with existing customers, with net new bookings in the first quarter 2018 of $418.4 million, up 10% over the prior year, led by strong performance in the Automotive business, as well as the Enterprise division.

During the quarter, Nuance demonstrated significant progress in the business with intensifying focus and investment in key vertical industries, including:

• Driving continued, significant adoption of Dragon Medical cloud as a platform in healthcare;

• Ongoing growth and adoption

• Introducing our new Dragon Drive automotive platform; and,

• Partnering with NVIDIA on the Nuance AI Marketplace for Diagnostic Imaging.

First Quarter of Fiscal 2018 Performance Highlights

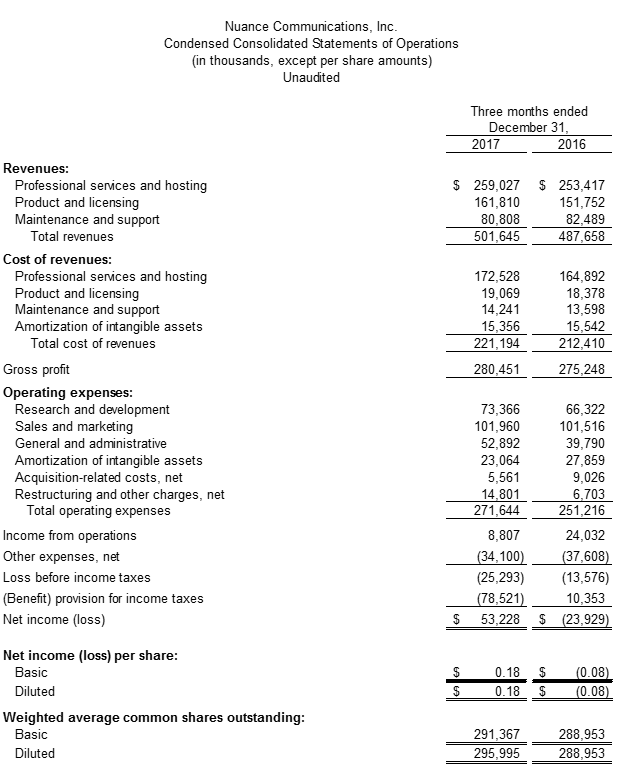

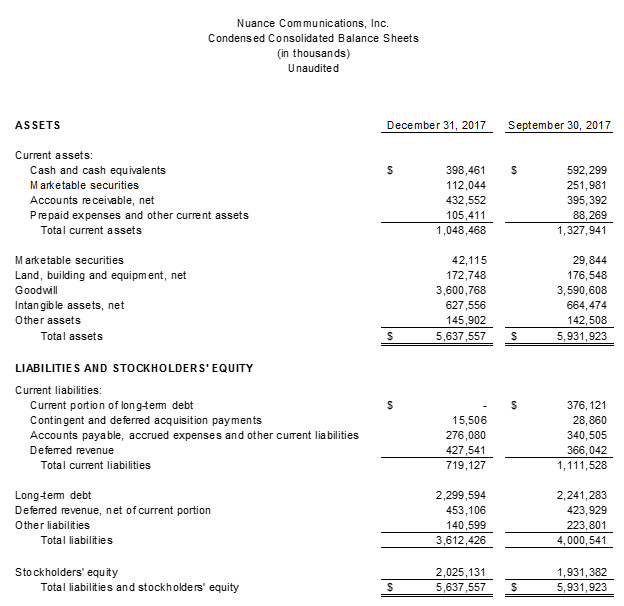

On a GAAP basis:

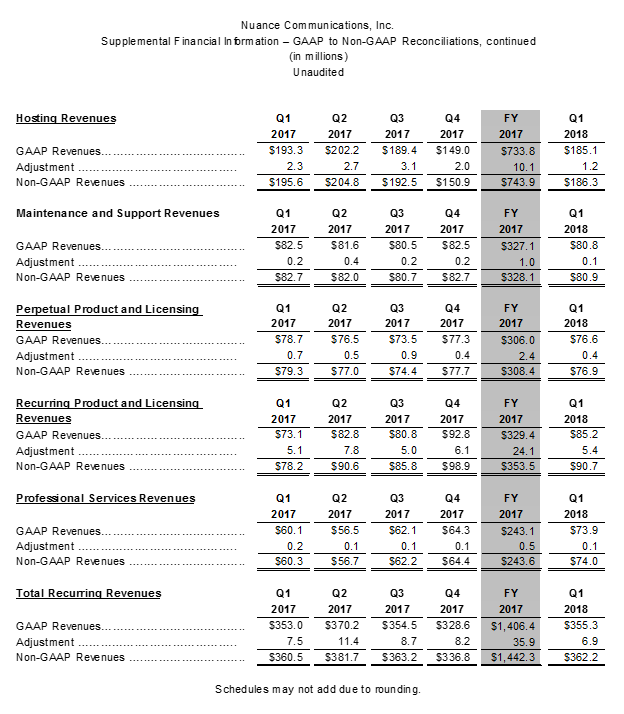

- GAAP revenue of $501.6 million, up 2.9% compared to $487.7 million a year ago.

- Total recurring revenue of 71% of total GAAP revenue, compared to 72% a year ago.

- GAAP net income of $53.2 million, or $0.18 per diluted share, compared to GAAP net loss of $(23.9) million, or $(0.08) per share, in the first quarter of fiscal 2017.

- GAAP operating margin of 1.8%, down from 4.9% in the first quarter of fiscal 2017.

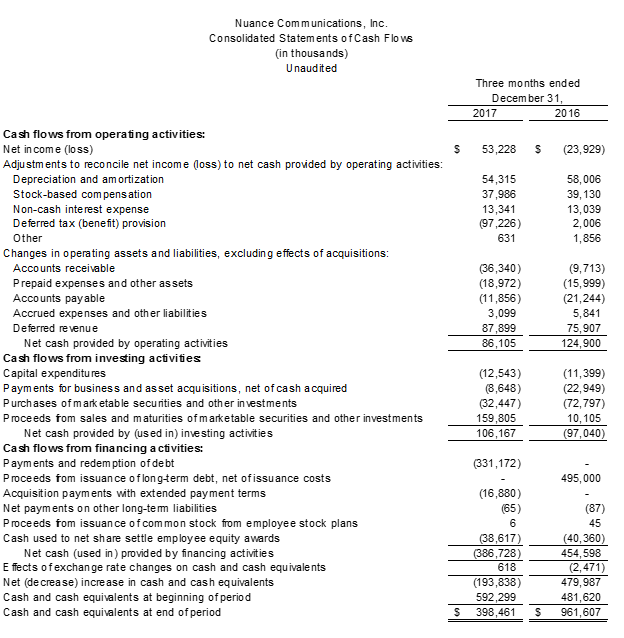

- Cash flow from operations of $86.1 million in the first quarter of fiscal 2018, down 31% from $124.9 million in the first quarter of fiscal 2017.

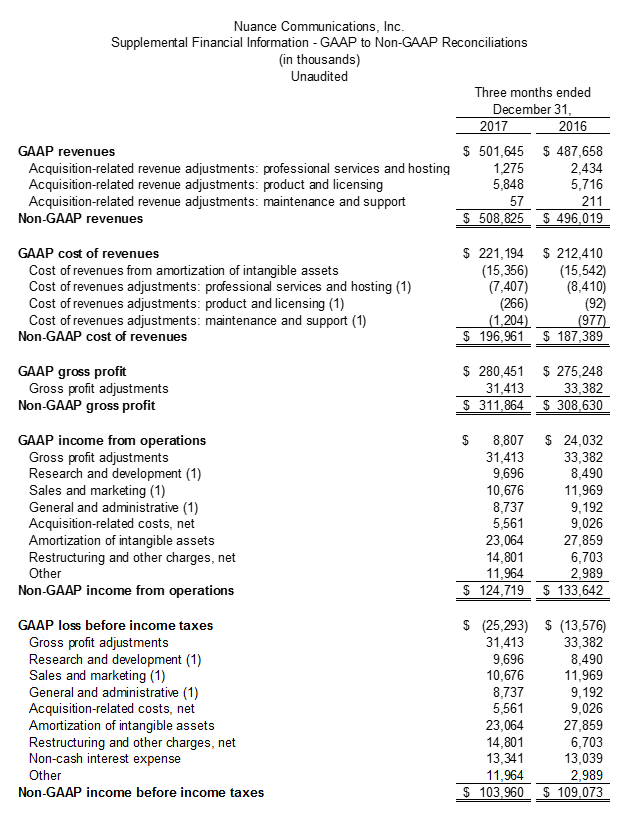

On a Non-GAAP basis:

-

- Net new bookings of $418.4 million, up 10% from $380.3 million a year ago.

- Non-GAAP recurring revenue of 71% of¬ total non-GAAP revenue, compared to 73% a year ago.

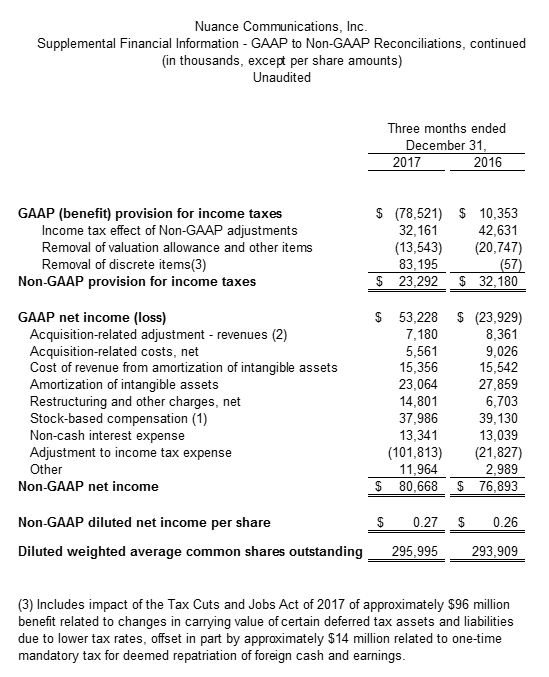

- Non-GAAP net income of $80.7 million, or $0.27 per diluted share, up from non-GAAP net income of $76.9 million, or $0.26 per diluted share, in the first quarter of fiscal 2017.

-

Guidance and Business Outlook

Current momentum in the business and strong market demand and pipeline, provide Nuance with confidence in its second quarter and FY 18 outlook. The Company expects to deliver annual net new bookings growth of between 5% to 7

For a complete discussion on Nuance’s guidance and business outlook, please

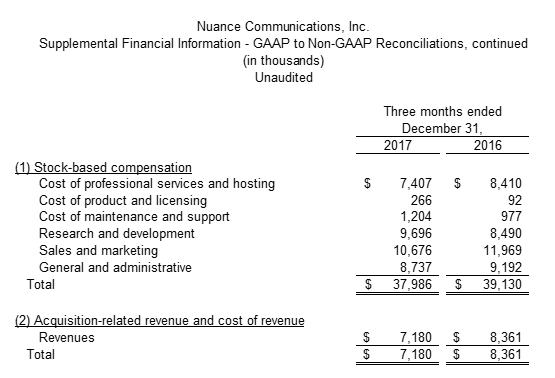

Please refer to the “Discussion of Non-GAAP Financial Measures,” and “GAAP to Non-GAAP Reconciliations,” included elsewhere in this release, for more information regarding the company’s use of non-GAAP.

Conference Call and Prepared Remarks

Nuance is providing a copy of prepared remarks in combination with its press release. These remarks are offered to provide shareholders and analysts with additional time and detail for analyzing results in advance of the company’s quarterly conference call. The remarks will be available at http://www.nuance.com/earnings-results/ in conjunction with the press release.

Nuance will host an investor conference call today that will begin at 5:00 p.m. ET and will include only brief comments followed by questions and answers. To access the live broadcast, please visit the Investor Relations section of Nuance’s website at http://investors.nuance.com. The call can also be heard by dialing 800-230-1059 or 612-234-9959 at least five minutes prior to the call and referencing code 442359. A replay will be available within 24 hours of the announcement by dialing 800-475-6701 or 320-365-3844 and using the access code 442359.

About Nuance Communications, Inc.

Nuance Communications, Inc. (NASDAQ: NUAN) is a leading provider of voice and language solutions for businesses and consumers around the world. Its technologies, applications

Trademark reference: Nuance and the Nuance logo are registered trademarks or trademarks of Nuance Communications, Inc. or its affiliates in the United States and/or other countries. All other trademarks referenced herein are the property of their respective owners.

Safe Harbor and Forward-Looking Statements

Statements in this document regarding future performance and our management’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” or “estimates” or similar expressions) should also be considered to be forward-looking statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including but not limited to: fluctuations in demand for our existing and future products; further unanticipated costs resulting from the FY17 malware incident including potential costs associated with litigation or governmental investigations that may result from the incident; inaccuracies in the assumptions underlying our estimates of lost revenue attributable to the malware incident; changes to economic conditions in the United States and internationally; fluctuating currency rates; our ability to control and successfully manage our expenses and cash position; our ability to execute our formal transformation program to reduce costs and optimize processes; the effects of competition, including pricing pressure; possible quality issues in our products and technologies; our ability to successfully integrate operations and employees of acquired businesses; the conversion rate of bookings into revenue; the ability to realize anticipated synergies from acquired businesses; and the other factors described in our annual report on Form 10-K for the fiscal year ended September 30, 2017. We disclaim any obligation to update any forward-looking statements as a result of developments occurring after the date of this document.

Definitions of Bookings and Net New Bookings

Bookings. Bookings represent the estimated gross revenue value of transactions at the time of contract execution, except for maintenance and support offerings. For fixed price contracts, the bookings value represents the gross total contract value. For contracts where revenue is based on transaction volume, the bookings value represents the contract price multiplied by the estimated future transaction volume during the contract term, whether or not such transaction volumes are guaranteed under a minimum commitment clause. Actual results could be different than our initial estimates. The maintenance and support bookings value represents the amounts billed in the period the customer is invoiced. Because of the inherent estimates required to determine bookings and the fact that the actual resultant revenue may differ from our initial bookings estimates, we consider bookings one indicator of potential future revenue and not as an arithmetic measure of

Net new bookings. Net new bookings

Discussion of Non-GAAP Financial Measures

We utilize a number of different financial measures, both Generally Accepted Accounting Principles (“GAAP”) and non-GAAP, in analyzing and assessing the overall performance of the business, for making operating decisions and for forecasting and planning for future periods. Our annual financial plan is prepared both on a GAAP and non-GAAP basis, and the non-GAAP annual financial plan is approved by our board of directors. Continuous budgeting and forecasting for revenue and expenses are conducted on a consistent non-GAAP basis (in addition to GAAP) and actual results on a non-GAAP basis are assessed against the non-GAAP annual financial plan. The board of directors and management utilize these non-GAAP measures and results (in addition to the GAAP results) to determine our allocation of resources. In addition, and as a consequence of the importance of these measures in managing the business, we use non-GAAP measures and results in the evaluation process to establish management’s compensation. For example, our annual bonus program payments are based upon the achievement of consolidated non-GAAP revenue and consolidated non-GAAP earnings per share financial targets. We consider the use of non-GAAP revenue helpful in understanding the performance of our business, as it excludes the purchase accounting impact on acquired deferred revenue and other acquisition-related adjustments to revenue. We also consider the use of non-GAAP earnings per share helpful in assessing the organic performance of the continuing operations of our business. By organic

Acquisition-Related Revenue and Cost of Revenue.

We provide supplementary non-GAAP financial measures of revenue, which include revenue related to acquisitions, primarily from TouchCommerce, NSI, Primordial, and Tweddle for the three months ended December 31,

Acquisition-Related Costs, Net.

In recent years, we have completed a number of acquisitions, which result in operating expenses which would not otherwise have been incurred. We provide supplementary non-GAAP financial measures, which exclude certain transition, integration and other acquisition-related expense items resulting from acquisitions, to allow more accurate comparisons of the financial results to historical operations, forward-looking guidance and the financial results of less acquisitive peer companies. We consider these types of costs and adjustments, to a great extent, to be unpredictable and dependent on a significant number of factors that are outside of our control. Furthermore, we do not consider these acquisition-related costs and adjustments to be related to the organic continuing operations of the acquired businesses and are generally not relevant to assessing or estimating the long-term performance of the acquired assets. In addition, the size, complexity and/or volume of past acquisitions, which often drives the magnitude of acquisition-related costs, may not be indicative of the size, complexity and/or volume of future acquisitions. By excluding acquisition-related costs and adjustments from our non-GAAP measures, management is better able to evaluate our ability to utilize our existing assets and estimate the long-term value that acquired assets will generate for us. We believe that providing a supplemental non-GAAP measure which excludes these items allows management and investors to consider the ongoing operations of the business both

These acquisition-related costs fall into the following categories: (i) transition and integration costs; (ii) professional service fees and expenses; and (iii) acquisition-related adjustments. Although these expenses are not recurring with respect to past acquisitions, we generally will incur these expenses in connection with any future acquisitions. These categories are further discussed as follows:

(i) Transition and integration costs. Transition and integration costs include retention payments, transitional employee costs, and earn-out payments treated as compensation expense, as well as the costs of integration-related activities, including services provided by third-parties.

(ii) Professional service fees and expenses. Professional service fees and expenses include financial advisory, legal, accounting and other outside services incurred in connection with acquisition activities, and disputes and regulatory matters related to acquired entities.

(iii) Acquisition-related adjustments. Acquisition-related adjustments include adjustments to acquisition-related items that are required to be marked to fair value each reporting period, such as contingent consideration, and other items related to acquisitions for which the measurement period has ended, such as gains or losses on settlements of pre-acquisition contingencies.

Amortization of Acquired Intangible Assets.

We exclude the amortization of acquired intangible assets from

Non-Cash Expenses.

We provide non-GAAP information relative to the following non-cash expenses: (i) stock-based compensation; and (ii) non-cash interest. These items are further discussed as follows:

(i) Stock-based compensation. Because of varying valuation methodologies, subjective assumptions and the variety of award types, we believe that excluding stock-based compensation allows for more accurate comparisons of operating results to peer companies, as well as to times in our history when stock-based compensation was more or less significant as a portion of overall compensation than in the current period. We evaluate performance both with and without these measures because compensation expense related to stock-based compensation is typically non-cash and the options and restricted awards granted are influenced by the Company’s stock price and other factors such as volatility that

(ii) Non-cash interest. We exclude non-cash interest because we believe that excluding this expense provides senior management, as well as other users of the financial statements, with a valuable perspective on the cash-based performance and health of the business, including the current near-term projected liquidity. Non-cash interest expense will continue in future periods.

Other Expenses.

We exclude certain other expenses that result from unplanned events in order to measure operating performance and current and future liquidity both with and without these expenses. By providing this information, we believe management and the users of the financial statements are better able to understand the financial results of what we consider to be our organic, continuing operations. Included in these expenses are items such as restructuring charges, asset impairments and other charges (credits), net. These events are unplanned and arise outside of the ordinary course of continuing operations. These items include losses from extinguishing our convertible debt. Other items such as consulting and professional services fees related to assessing strategic alternatives and our transformation program, implementation of the new revenue recognition standard (ASC 606), and expenses associated with the malware incident and remediation thereof are also excluded.

Non-GAAP Income Tax Provision.

Effective Q2 2017, we changed our method of calculating our non-GAAP income tax provision. Under the prior method, we calculated our non-GAAP tax provision using a cash tax method to reflect the estimated amount we expected to pay or receive in taxes related to the period, which is equivalent to our GAAP current tax provision. Under the new method, our non-GAAP income tax provision is determined based on our non-GAAP pre-tax income. The tax effect of each non-GAAP adjustment, if applicable, is computed based on the statutory tax rate of the jurisdiction to which the adjustment relates. Additionally, as our non-GAAP profitability is higher based on the non-GAAP adjustments, we adjust the GAAP tax provision to remove valuation allowances and related effects based on the higher level of reported non-GAAP profitability. We also exclude from our non-GAAP tax provision certain discrete tax items as they occur, which in

We believe that providing the non-GAAP information to investors, in addition to the GAAP presentation, allows investors to view the financial results in the way management views the operating results. We further believe that providing this information allows investors to not only better understand our financial

The non-GAAP information included in this press release should not be considered superior to, or a substitute for, financial statements prepared in accordance with GAAP.

Contact Information

For Investors/Media

Richard Mack

Nuance Communications, Inc.

Tel: 781-565-5000

Email: richard.mack@nuance.com

Financial Tables Follow