Burlington, Mass., January 22, 2018 - Nuance Communications, Inc. (NASDAQ: NUAN) today announced preliminary results for its first quarter of fiscal 2018 and provided updates on executive leadership.

Strong Preliminary Q1 2018 Results

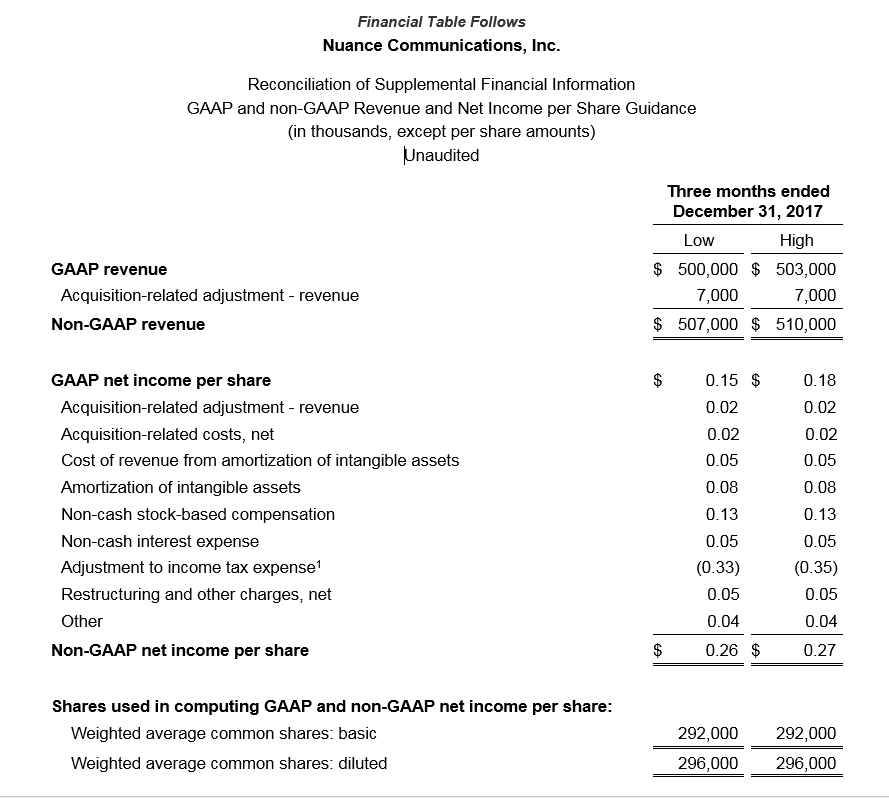

Based on preliminary financial data, Nuance expects fiscal first quarter GAAP revenues to be between $500.0 million and $503.0 million and non-GAAP revenues to be between $507.0 million and $510.0 million. The company expects fiscal

These GAAP and non-GAAP revenue and earnings per share preliminary ranges are above the guidance ranges previously provided on November 28, 2017, for fiscal

These preliminary expectations are subject to revision until the Company reports final first quarter fiscal 2018 results on February 8, 2018. (Please see today’s separate advisory for details.)

Imaging Division Leadership, Al Monserrat Named EVP and GM

Al Monserrat, an accomplished technology veteran and the former CEO of RES Software, has joined the Company as an executive vice president and the general manager of its Imaging business. Mr. Monserrat has more than 25 years of broad technology and software experience, and a proven track record for developing successful strategies that result in expanded market

“With years of technology and software experience, Al has successfully led the strategic transformation of numerous businesses, resulting in accelerated growth, market expansion, and improved go-to-market capabilities. We are pleased to welcome Al to our team as we mark this new chapter for our Imaging business,” said Paul Ricci, chairman

Mobile Division Reorganization and Leadership Update

Nuance announced that it is reorganizing its Mobile division to improve efficiency and better serve customers. Nuance’s Mobile Communications Service Provider (CSP) business will be merged into the Enterprise division, reporting to Robert Weideman, EVP

CEO Succession Planning

The Nuance Board of Directors confirmed that Paul Ricci will retire as CEO on or before March 31, 2018. The Search Committee has advanced its selection process and intends to appoint a new CEO on or before that date. In light of Mr. Ricci’s expected retirement as CEO, the Board will not nominate him for election as a director at the 2018 annual meeting of shareholders.

About Nuance Communications, Inc.

Nuance Communications, Inc. is a leading provider of voice and language solutions for businesses and consumers around the world. Its technologies, applications

Trademark reference: Nuance and the Nuance logo are registered trademarks or trademarks of Nuance Communications, Inc. or its affiliates in the United States and/or other countries. All other trademarks referenced herein are the property of their respective owners.

Safe Harbor and Forward-Looking Statements

Statements in this document regarding future performance and our management’s future expectations, beliefs, goals, plans or prospects constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements that are not statements of historical fact (including statements containing the words “believes,” “plans,” “anticipates,” “expects,” or “estimates” or similar expressions) should also be considered to be forward-looking statements. There are a number of important factors that could cause actual results or events to differ materially from those indicated by such forward-looking statements, including but not limited to: finalizing our quarterly accounting close, including completion of account reconciliations and reviews by financial management and final analysis of the impact of the recently enacted Tax Cut and Jobs Act of 2017; finalizing our calculation of weighted average shares outstanding; finalizing the preparation of our statement of cash flows; finalizing the preparation, valuation procedures and financial management review of our net new bookings during the quarter; our ability to finalize the selection process for, and negotiating mutually acceptable employment terms with, a successor CEO within the stated timeframe; and, the other factors described in our annual report on Form 10-K for the fiscal year ended September 30, 2017 and our other subsequent reports filed with the Securities and Exchange Commission. We disclaim any obligation to update any forward-looking statements as a result of developments occurring after the date of this document.

Definitions of Bookings and Net New Bookings

Certain supplemental data provided in the announcement are based upon internal Nuance definitions that are important for the reader to understand.

Bookings. Bookings represent the estimated gross revenue value of transactions at the time of contract execution, except for maintenance and support offerings. For fixed price contracts, the bookings value represents the gross total contract value. For contracts where revenue is based on transaction volume, the bookings value represents the contract price multiplied by the estimated future transaction volume during the contract term, whether or not such transaction volumes are guaranteed under a minimum commitment clause. Actual results could be different than our initial estimates. The maintenance and support bookings value represents the amounts billed in the period the customer is invoiced. Because of the inherent estimates required to determine bookings and the fact that the actual resultant revenue may differ from our initial bookings estimates, we consider bookings one indicator of potential future revenue and not as an arithmetic measure of

Net new bookings. Net new bookings

Discussion of non-GAAP Financial Measures

We utilize a number of different financial measures, both Generally Accepted Accounting Principles (“GAAP”) and non-GAAP, in analyzing and assessing the overall performance of the business, for making operating decisions and for forecasting and planning for future periods. Our annual financial plan is prepared both on a GAAP and non-GAAP basis, and the non-GAAP annual financial plan is approved by our board of directors. Continuous budgeting and forecasting for revenue and expenses are conducted on a consistent non-GAAP basis (in addition to GAAP) and actual results on a non-GAAP basis are assessed against the non-GAAP annual financial plan. The board of directors and management utilize these non-GAAP measures and results (in addition to the GAAP results) to determine our allocation of resources. In addition and as a consequence of the importance of these measures in managing the business, we use non-GAAP measures and results in the evaluation process to establish management’s compensation. For example, our annual bonus program payments are based upon the achievement of consolidated non-GAAP revenue and consolidated non-GAAP earnings per share financial targets. We consider the use of non-GAAP revenue helpful in understanding the performance of our business, as it excludes the purchase accounting impact on acquired deferred revenue and other acquisition-related adjustments to revenue. We also consider the use of non-GAAP earnings per share helpful in assessing the organic performance of the continuing operations of our business. By organic

Acquisition-related revenue and cost of revenue.

We provide supplementary non-GAAP financial measures of revenue, which include revenue related to acquisitions, primarily TouchCommerce, NSI

Acquisition-related costs, net.

In recent years, we have completed a number of acquisitions, which result in operating expenses, which would not otherwise have been incurred. We provide supplementary non-GAAP financial measures, which exclude certain transition, integration and other acquisition-related expense items resulting from acquisitions, to allow more accurate comparisons of the financial results to historical operations,

These acquisition-related costs fall into the following categories: (i) transition and integration costs; (ii) professional service fees and expenses; and (iii) acquisition-related adjustments. Although these expenses are not recurring with respect to past acquisitions, we generally will incur these expenses in connection with any future acquisitions. These categories are further discussed as follows:

(i) Transition and integration costs. Transition and integration costs include retention payments, transitional employee costs, and earn-out payments treated as compensation expense, as well as the costs of integration-related activities, including services provided by third-parties.

(ii) Professional service fees and expenses. Professional service fees and expenses include financial advisory, legal, accounting and other outside services incurred in connection with acquisition activities, and disputes and regulatory matters related to acquired entities.

(iii) Acquisition-related adjustments. Acquisition-related adjustments include adjustments to acquisition-related items that are required to be marked to fair value each reporting period, such as contingent consideration, and other items related to acquisitions for which the measurement period has ended, such as gains or losses on settlements of pre-acquisition contingencies.

Amortization of acquired intangible assets.

We exclude the amortization of acquired intangible assets from

Non-cash expenses.

We provide non-GAAP information relative to the following non-cash expenses: (i) stock-based compensation; and (ii) non-cash interest. These items are further discussed as follows:

(i) Stock-based compensation. Because of varying valuation methodologies, subjective assumptions and the variety of award types, we believe that excluding stock-based compensation allows for more accurate comparisons of operating results to peer companies, as well as to times in our history when stock-based compensation was more or less significant as a portion of overall compensation than in the current period. We evaluate performance both with and without these measures because compensation expense related to stock-based compensation is typically non-cash and the options and restricted awards granted are influenced by the Company’s stock price and other factors such as volatility that

(ii) Non-cash interest. We exclude non-cash interest because we believe that excluding this expense provides senior management, as well as other users of the financial statements, with a valuable perspective on the cash-based performance and health of the business, including the current near-term projected liquidity. Non-cash interest expense will continue in future periods.

Other Expenses.

We exclude certain other expenses that result from unplanned events in order to measure operating performance and current and future liquidity both with and without these expenses. By providing this information, we believe management and the users of the financial statements are better able to understand the financial results of what we consider to be our organic, continuing operations. Included in these expenses are items such as restructuring charges, asset impairments and other charges (credits), net. These events are unplanned and arise outside of the ordinary course of continuing operations. These items include losses from extinguishing our convertible debt. Other items such as consulting and professional services fees related to assessing strategic alternatives and our transformation program, implementation of the new revenue recognition standard (ASC 606), and expenses associated with the malware incident and remediation thereof are also excluded.

Non-GAAP Income Tax Provision.

Our non-GAAP income tax provision is determined based on our non-GAAP pre-tax income. The tax effect of each non-GAAP adjustment, if applicable, is computed based on the statutory tax rate of the jurisdiction to which the adjustment relates. Additionally, as our non-GAAP profitability is higher based on the non-GAAP adjustments, we adjust the GAAP tax provision to remove valuation allowances and related effects based on the higher level of reported non-GAAP profitability. We also exclude from our non-GAAP tax provision certain discrete tax items as they occur.

We believe that providing the non-GAAP information to investors, in addition to the GAAP presentation, allows investors to view the financial results in the way management views the operating results. We further believe that providing this information allows investors to not only better understand our financial

Contact Information

Richard Mack

Nuance Communications, Inc.

Tel: 781-565-5000

Email: richard.mack@nuance.com

Financial Table Follows

1In December 2017, Congress passed the Tax Cut and Jobs Act of 2017 (the “Act”). We are currently assessing the tax accounting resulting from the Act and expect this new legislation to have a material impact on our GAAP tax results. We have currently estimated our GAAP tax provision for the first quarter of fiscal 2018 to be benefited by approximately $80 million driven by a revaluation of certain deferred tax assets and liabilities using the updated federal tax rates, offset in part by a one-time repatriation tax on non-US cash and earnings. Our evaluation of the tax accounting remains in